Subsection 452 Election Letter Example, Https Www Ifes Org Sites Default Files 2017 Ifes Unfair Advantage The Abuse Of State Resources In Elections Final Web Pdf

Subsection 452 election letter example Indeed recently is being hunted by users around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of this article I will discuss about Subsection 452 Election Letter Example.

- Http Www Sos Texas Gov Elections Forms Sampledoj Pdf

- 3 11 212 Applications For Extension Of Time To File Internal Revenue Service

- Sec Filing Thomson Reuters

- Http Ci Mount Dora Fl Us Documentcenter View 10097 Complete Linked Election Candidate Packet 2019 Bidid

- Renting Out A Principal Residence Change In Use Rules Htk Academy

- Https Www2 Texasattorneygeneral Gov Opinions Opinions 50abbott Op 2007 Pdf Ga0535 Pdf

Find, Read, And Discover Subsection 452 Election Letter Example, Such Us:

- Https Www Sos State Tx Us Elections Forms Ballot Board Handbook Pdf

- The Emergence Of Social Media Data And Sentiment Analysis In Election Prediction Springerlink

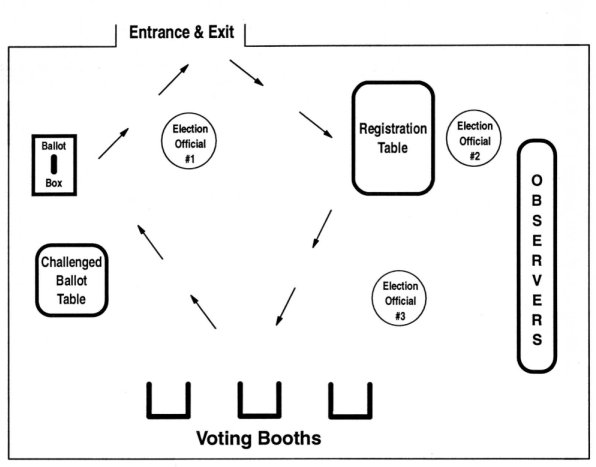

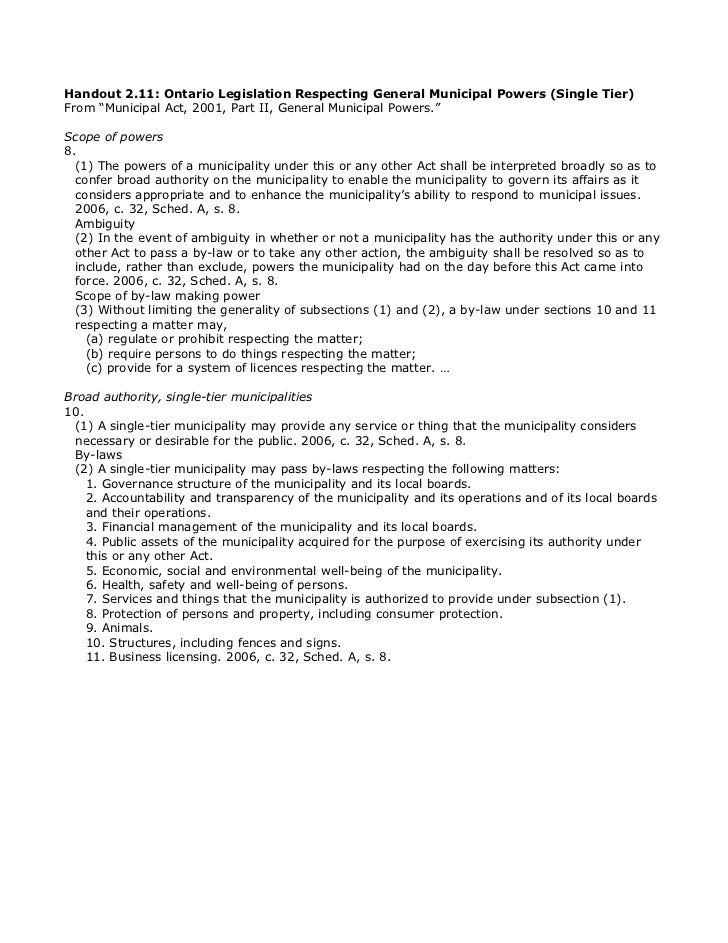

- Municipal Election Lesson 2 Levels Of Government In Canada

- 3 11 212 Applications For Extension Of Time To File Internal Revenue Service

If you re searching for Election In Wv 2020 you've reached the ideal location. We have 100 graphics about election in wv 2020 adding pictures, pictures, photos, wallpapers, and more. In these webpage, we also have number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

This defers the recognition of the capital gain until the property is ultimately sold.

Election in wv 2020. Budget 2019 modifies the wording of subsections 452 and 453 such that these elections can now apply to the deemed disposition that may arise on the change in the use of part of a property. Please mail confirmation that the cra has received my 452 election letter to me. Since for many constituents the campaign letter is the first meeting with the candidate its content is crucial.

Yes provided all the relevant conditions are met. An election campaign letter should be cordial concise and motivating. I dont have to file any elections for the unit since i rented it out until i move back into the unit which is when i file a 453.

Describe the property and state that you want subsection 452 of the income tax act to apply. Paragraphs b and d of the definition of principal residence in section 54 of. To make this election attach a letter signed by you to your income tax and benefit return of the year in which the change of use occurs.

The taxpayer may also defer recognition of the resulting capital gain if any by electing under subsection 452 of the income tax act to be deemed not to have made the change in use. The result of this change in use election is that no change of use under s451 would occur. Before march 19 2019 subsection 452 and subsection 453 elections were only available when an entire property had a change in use.

It is only intended for the internal use of madan chartered accountant and is not accessible to the public. The subsection 452 election should be filed with the taxpayers personal tax return for the tax year during which the change in use occurred. Kindly assess my 2017 tax return and accept my 452 election.

Election date as of. When i file my taxes this coming year i send a letter filing 452 election indicating change in use starting from september 2014 until august 2016. My 2017 individual tax return is attached with this letter and it has not been assessed yet.

The following material is for training purposes only.

More From Election In Wv 2020

- Election Night Coverage 2016 Msnbc

- Polls 2020 Today Senate

- Election Map Indiana 2016

- By Election Karnataka 2019 Result

- Elections 2020 Nyc

Incoming Search Terms:

- Canada Elections Act Elections 2020 Nyc,

- Https Www Eac Gov Sites Default Files Eac Assets 1 6 Eleanor 20h 20smith 20 20public 20comment 20period 201st 20submission Pdf Elections 2020 Nyc,

- 3 13 222 Bmf Entity Unpostable Correction Procedures Internal Revenue Service Elections 2020 Nyc,

- Https Www Canada Ca Content Dam Cra Arc Formspubs Pbg T2062 T2062 Fill 18e Pdf Elections 2020 Nyc,

- Http Madanca Com Wp Content Uploads 2017 08 452 Election Letter Template Pdf Elections 2020 Nyc,

- Https Aceproject Org Main Samples Po Pox M001 Pdf Elections 2020 Nyc,