Qsub Election Form, Pdf Civil Religion A Window Into Perennial Themes Of Political Philosophy Ronald Beiner Academia Edu

Qsub election form Indeed lately has been sought by consumers around us, maybe one of you. Individuals now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of the article I will talk about about Qsub Election Form.

- Http Www Gsblaw Com Pdfs Qualified Subchapter Jtax Brant 09 2016 Pdf

- W 9 For Qsub Fill Online Printable Fillable Blank Form 8869 Com

- Http Edocket Access Gpo Gov Cfr 2009 Aprqtr Pdf 26cfr1 1361 4 Pdf

- Form 8869 Qualified Subchapter S Subsidiary Election 2014 Free Download

- Https Www State Nj Us Treasury Revenue Pdf Sub S Pdf

- 1 1361 5 A 4 Example 3 No Termination Of Qsub Election Youtube

Find, Read, And Discover Qsub Election Form, Such Us:

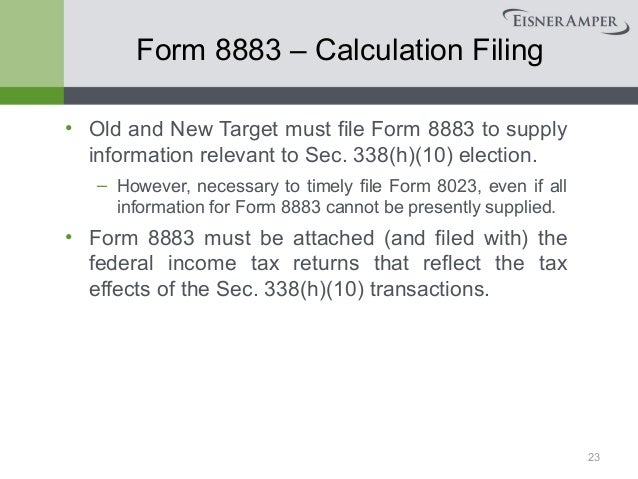

- S Corporations 2013 Tax Update And M A Issues Considerations November 15 Pdf Free Download

- Http Edocket Access Gpo Gov Cfr 2009 Aprqtr Pdf 26cfr1 1361 4 Pdf

- Ppt Tax Aspects Of Buying Or Selling A Business Powerpoint Presentation Id 638810

- Irs Form 8869 Download Fillable Pdf Or Fill Online Qualified Subchapter S Subsidiary Election Templateroller

- Http Files Hawaii Gov Tax Legal Tir 1990 09 Tir01 01 Pdf

If you re looking for Election Polls 2020 Battleground States you've arrived at the right location. We have 100 images about election polls 2020 battleground states including pictures, pictures, photos, wallpapers, and more. In such page, we additionally have number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

A qsub is a domestic corporation that itself would be eligible to make an s corporation election if it had only eligible shareholders and is 100 percent owned by an s corporation that makes the qsub election for its subsidiary.

Election polls 2020 battleground states. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362a to be an s corporation. Following the deemed liquidation the qsub is not treated as a separate corporation and all of the subsidiarys assets liabilities and items of income deduction. However a qsub election can only be made when the electing parent corporation is an s corporation.

Making the qsub or qsss election. In order to be treated as a qsub or qsss or whatever you want to call the child s corporation the parent s corporation makes a qualified subchapter s subsidiary election using a form 8869 by march 15 of the first year the parent s corporation wants to treat the child s corporation as a qsub. The parent s corporation can make the qsub election at any time during the tax year.

However the requested effective date of the qsub election generally cannot be more than. A parent s corporation uses form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter s subsidiary qsub. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec.

Except as provided in section 1361b3d and 11361 5c five year prohibition on re election an s corporation may elect to treat an eligible subsidiary as a qsub by filing a completed form to be prescribed by the irs. 12 months after the date the election is filed or 2 months and 15 days before the date the election is filed. Form 8869 with a stamped irs received date.

Qsub elections are made on form 8869 qualified subchapter s subsidiary election. For paperwork reduction act notice see instructions. The parent s corporation may make the qsub election at any time during the tax year.

Qsub elections can be effective any time during the year and thus a qsub election in the simple example above could be made at any time through december 31 2000 and qualify for transitional relief. However the requested effective date of the qsub election generally cannot be more than 12 months after the date the election is filed or two months and 15 days before the date. Election mechanics the qsub requirements must be sat isfied at the time the election is effec tive and for all periods thereafter86 the election form must be signed by a person authorized to.

The qsub election results in a deemed liquidation of the subsidiary into the parent. Qsub elections are made on form 8869 qualified subchapter s subsidiary election. End of election once the qsub election is made it remains in effect until it is terminated.

Form 8869 Qualified Subchapter S Subsidiary Election 2014 Free Download Election Polls 2020 Battleground States

More From Election Polls 2020 Battleground States

- Amerika Secimleri Adaylari

- Vat Election Letter

- Election Card Smart Card Online India

- By Election Kerala 2019 Vattiyoorkavu

- Election In Delhi 2020 Live Update

Incoming Search Terms:

- Pdf Civil Religion A Window Into Perennial Themes Of Political Philosophy Ronald Beiner Academia Edu Election In Delhi 2020 Live Update,

- 2 Election In Delhi 2020 Live Update,

- Https Www Oataxpro Com Assets Files Presentations Be 10 S Corporation Eligibility Available Elections Pdf Election In Delhi 2020 Live Update,

- Https Nanopdf Com Download Disregarded Entities To Be Or Not To Be Pdf Election In Delhi 2020 Live Update,

- Http Files Hawaii Gov Tax Forms 2016 N35ins Pdf Election In Delhi 2020 Live Update,

- Situational Charts Of F Reorganizations Of S Corporations International Tax Blog Election In Delhi 2020 Live Update,