S Election Letter From Irs, Solved The Selection Of An Accounting Method For Tax Purp Chegg Com

S election letter from irs Indeed lately is being hunted by users around us, perhaps one of you. People now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of the article I will talk about about S Election Letter From Irs.

- How To Terminate An S Corp Election And Revert To An Llc Legalzoom Com

- How To Obtain A Copy Of A Filed Sub S Corp Election Legalzoom Com

- 5 8 8 Acceptance Processing Internal Revenue Service

- Https Www Incnow Com Downloads Incnowtaxandlegalpacket Pdf

- 20 1 9 International Penalties Internal Revenue Service

- Https Www Guidestar Org Viewedoc Aspx Edocid 3782861 Approved True

Find, Read, And Discover S Election Letter From Irs, Such Us:

- Https Www Irs Gov Pub Newsroom 2011 Ovdi Opt Out And Removal Guide And Memo June 1 2011 Pdf

- Tax Letters Explained

- A Christian Voter Intimidation Letter From Americans United For Separation Of Church And State Wallbuilders

- Irs Audit Letter 12c Sample 1

- 4 19 10 Examination General Overview Internal Revenue Service

If you are searching for Conclusion Of Election In India you've come to the right place. We have 104 images about conclusion of election in india adding pictures, pictures, photos, wallpapers, and much more. In these web page, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

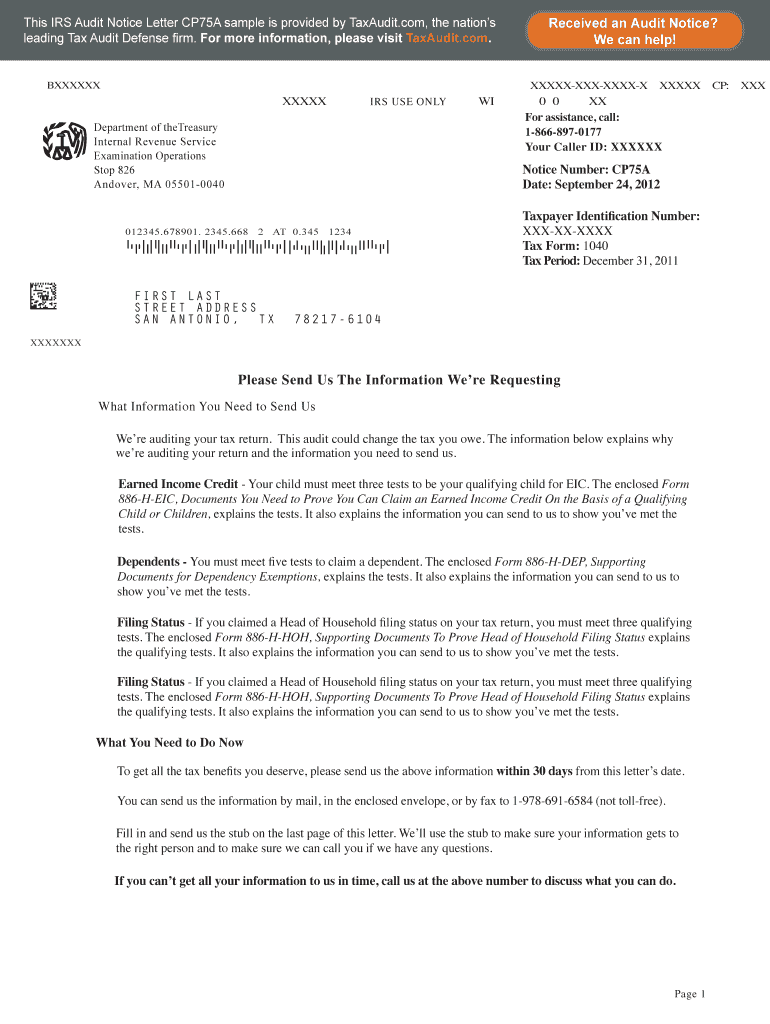

Alternatively if your request for late election relief is rejected the irs may send you a.

Conclusion of election in india. After you file your late s corporation election. Updated august 12 2020. In most cases an s corporation is initially formed as a different type of entity in its state of operation before the election is made such as a c corporation or limited.

This is the department a corporation calls to obtain a copy of almost any letter from the irs regarding business matters including subchapter s elections and employer identification number assignments. I donated to democratic candidates for president senate and house elections. Current revision form 2553 pdf form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec.

How long does the s corporation election filing take. The irs agent either can mail or fax you a copy of your s corporation election form or send you an official letter that acknowledges the irs acceptance of your election request. Check s corp status.

Anyway i already spent the 1200 stimulus check. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362a to be an s corporation. To apply just fill out irs form 2553 and theyll send you a ruling letter within 60 days that states whether or not your business has been approved to become an s corpthis is known as a cp261 notice and youll have to keep it in your permanent records along with a copy of your form 2553 youll need.

Within a few months the irs should send you a determination letter stating the effective date of your s corporation election. If you have properly submitted your s corporation form to the irs and have not heard back you can call the irs at 800 829 4933 and they will inform you of your application status. How to request an s corporation acceptance letter from the irs.

In order to successfully be qualified as an s corporation the company must be incorporated even before filing the form 2553. They will then be able to provide you with a copy of the approval letter. When you receive a copy of the approval letter be sure to keep it in a safe place.

Call the internal revenue services business and specialty tax line. The phone number is 800 829 4933. You can check your s corp status relatively easily by contacting the irs.

Request a copy of form 2553. Its using the irs to pay for trumps campaign and its deceitful. An s corporation business structure is an elected structure for tax purposes.

After you file your late s corporation election all you can do is wait. Once the form is filed the internal revenue service will send a letter back to the mailing address listed on the form confirming the election for this tax treatment. After the irs agent verifies your authorization explain that you need a copy of your s corporation election documents.

More From Conclusion Of Election In India

- Zoom Polls Examples

- Pistola A Tamburo Fortnite Dove Si Trova

- Wahl Usa Clippers

- Election Russia

- Us Presidential Election Time Table

Incoming Search Terms:

- Irs Violated Taxpayer Bill Of Rights With 2019 Crypto Letters Watchdog Coindesk Us Presidential Election Time Table,

- 1 200 Stimulus 9 Million Americans Getting Letter From Irs King5 Com Us Presidential Election Time Table,

- How To Terminate An S Corp Election And Revert To An Llc Legalzoom Com Us Presidential Election Time Table,

- It S Not A Scam Irs Is Really Sending Out Identity Verification Letters Us Presidential Election Time Table,

- Change Your Llc Tax Status To A Corporation Or S Corp Us Presidential Election Time Table,

- Http Www Democracy21 Org Wp Content Uploads 2016 03 D21 Clc Letter To Irs Re Crossroads Decision 3 3 16 Pdf Us Presidential Election Time Table,