S Election Irs Letter, What Is Form 2553 And How Do I File It Ask Gusto

S election irs letter Indeed lately is being sought by consumers around us, perhaps one of you personally. People now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the title of this post I will talk about about S Election Irs Letter.

- 3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

- Estate Planning And Administration For S Corporations Pdf Free Download

- 21 Tax Comparing Between S And C Corporations Tax Service Accounting Buffalo Grove Il

- The Irs S New Streamlined Audit Rules For Partnerships The Cpa Journal

- Beware Fake Irs Letters Are Making The Rounds This Summer

- Remember How The Irs 1040 Form Was Going To Be On A Postcard Here S Why It Didn T Happen

Find, Read, And Discover S Election Irs Letter, Such Us:

- Form 1040 Wikipedia

- What Is Form 2553 And How Do I File It Ask Gusto

- Https Www Irs Gov Pub Notices Cp261 English Pdf

- Resources Rle Taxes

- 4 10 8 Report Writing Internal Revenue Service

If you are searching for Electron Js Laravel you've come to the ideal place. We have 104 graphics about electron js laravel adding images, photos, photographs, backgrounds, and more. In such webpage, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Shareholders of s corporations report the flow through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates.

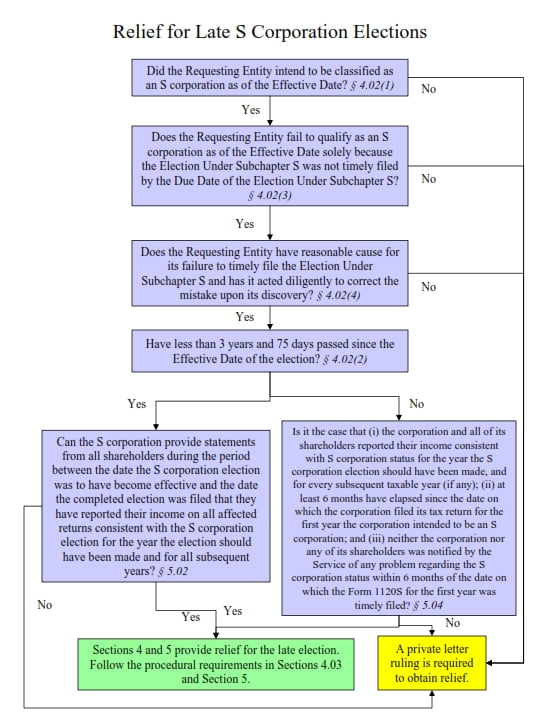

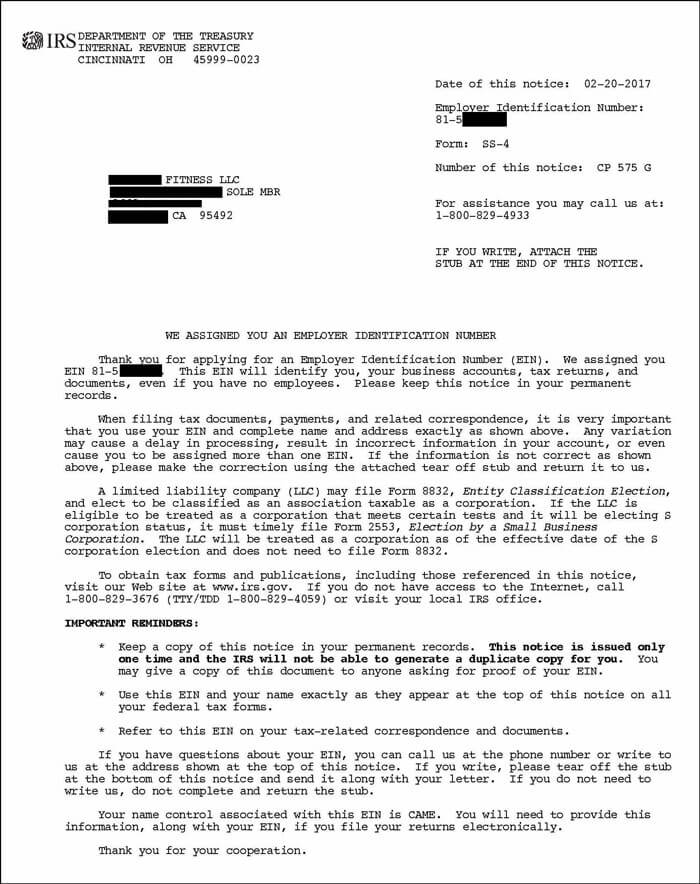

Electron js laravel. After the irs agent verifies your authorization explain that you need a copy of your s corporation election documents. If you have properly submitted your s corporation form to the irs and have not heard back you can call the irs at 800 829 4933 and they will inform you of your application status. How long does the s corporation election filing take.

Upon receipt of the corporate stock shares the two beneficiaries of the estate requested permission for the company to reelect to be an s corporation before the expiration of the five year waiting period for. The phone number is 800 829 4933. After you file your late s corporation election.

What you need to do keep this s corporation approval letter cp261 notice in your permanent records. Request a copy of form 2553. How to request an s corporation acceptance letter from the irs.

S corporations are corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes. Call the internal revenue services business and specialty tax line. This is the department a corporation calls to obtain a copy of almost any letter from the irs regarding business matters including subchapter s elections and employer identification number assignments.

Updated august 12 2020. For most taxpayers s corporations and other pass through entities are still slightly ahead of their c corporation brothers when it comes to income tax efficiency. Within a few months the irs should send you a determination letter stating the effective date of your s corporation election.

Alternatively if your request for late election relief is rejected the irs may send you a. In order to legally run as an s corp you have to apply and be approved by the irs. You can check your s corp status relatively easily by contacting the irs.

In most cases an s corporation is initially formed as a different type of entity in its state of operation before the election is made such as a c corporation or limited. After you file your late s corporation election all you can do is wait. Timely file form 1120s us.

An s corporation business structure is an elected structure for tax purposes. But if your s corporations s election is busted you could be looking at corporate level income taxes interest and penalties on three years worth of returns. The irs agent either can mail or fax you a copy of your s corporation election form or send you an official letter that acknowledges the irs acceptance of your election request.

To apply just fill out irs form 2553 and theyll send you a ruling letter within 60 days that states whether or not your business has been approved to become an s corpthis is known as a cp261 notice and youll have to keep it in your permanent records along with a copy of your form 2553 youll need. Cp261 is the approval notice for form 2553 election by a small business corporation.

More From Electron Js Laravel

- Election Day Meme 2020

- Election Day Application

- Polls 2020 Harrison

- Trump Airlines Cabin

- Elections 2020 Results Sri Lanka

Incoming Search Terms:

- 3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service Elections 2020 Results Sri Lanka,

- Irs Prioritizes Cryptocurrency Now First Question On 1040 Tax Form Bitcoin News Elections 2020 Results Sri Lanka,

- Form 5 Partnership Instructions Ten Common Mistakes Everyone Makes In Form 5 Partnership Ins In 2020 Power Of Attorney Form Irs Forms Reference Letter Elections 2020 Results Sri Lanka,

- Filling Out Irs Form 8832 An Easy To Follow Guide Youtube Elections 2020 Results Sri Lanka,

- 4 19 10 Examination General Overview Internal Revenue Service Elections 2020 Results Sri Lanka,

- Irs Form 2553 Instructions How And Where To File This Tax Form Elections 2020 Results Sri Lanka,

:max_bytes(150000):strip_icc()/Screenshot89-3accd2ef721540f8887b07064b824084.png)