Election Form Capital Gains, Https 0901 Nccdn Net 4 2 000 000 01e 20c Principalresidencesale Pdf

Election form capital gains Indeed lately has been hunted by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of this post I will discuss about Election Form Capital Gains.

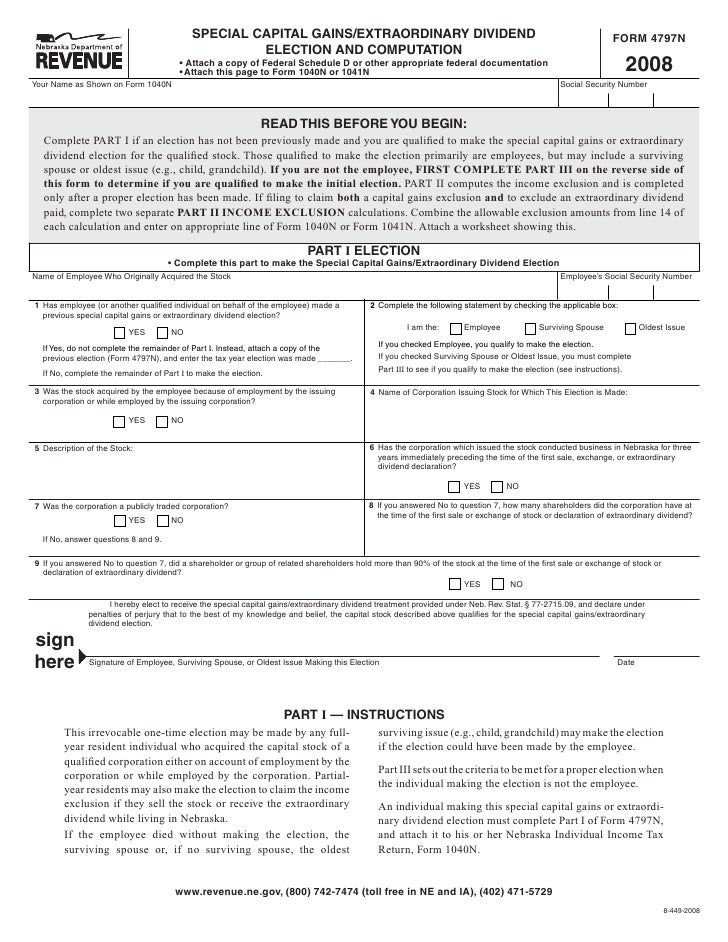

- Mark To Market For Form 4797

- Form 4797n Download Fillable Pdf Or Fill Online Special Capital Gains Extraordinary Dividend Election And Computation 2019 Nebraska Templateroller

- Fillable Online Form 4797n 2013 Special Capital Gains Election And Computation 11 2013 Fax Email Print Pdffiller

- Guide To Completing The Section 85 Tax Deferral Election Pdf Free Download

- Form 4797n Fillable Special Capital Gains Election And Computation 12 2014

- English Tax Form Sa107 Capital Gains Summary From Hm Revenue And Customs Lies On Table With Office Items Hmrc Paperwork And Tax Paying Process In Uni Stock Photo Alamy

Find, Read, And Discover Election Form Capital Gains, Such Us:

- Capital Gains For Itr Filing How To Calculate Capital Gains

- 2

- Stock Based Compensation Back To Basics

- 2

- Https Www Canada Ca Content Dam Cra Arc Formspubs Pbg T657 T657 12e Pdf

If you re looking for Election Commission Of India Card Check you've arrived at the perfect location. We ve got 100 images about election commission of india card check including images, photos, photographs, backgrounds, and more. In such webpage, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Https Www Titanmedicalinc Com Wp Content Uploads 2016 06 Pfic Annual Information Statement 2013 Pdf Election Commission Of India Card Check

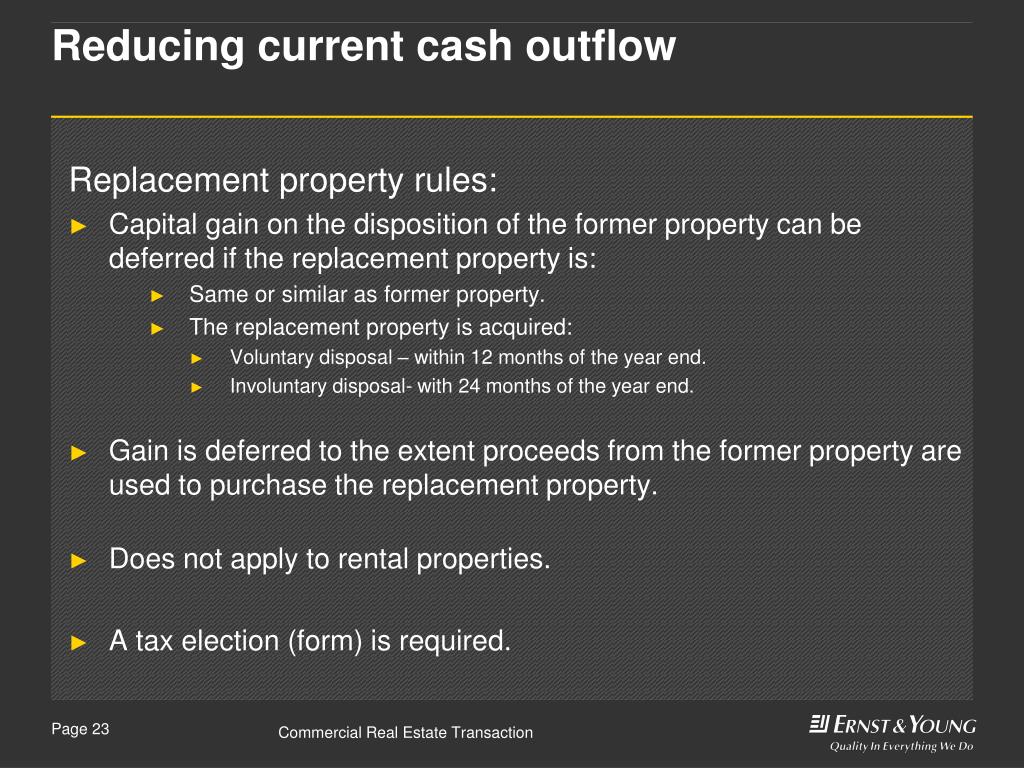

We provide step by step instructions on how to complete form t664 in chapter 2 which begins on page 9.

Election commission of india card check. Capital gains tax cap election instructions and form this form is for superannuation funds and their members to make a capital gains tax cgt cap election nat 71161. There was however a one time election made on form t664 that allowed you to bump up the tax cost of the property by a maximum of 100000. Gains on investments held for a year or less are treated as short term capital gains which get the same tax rate as ordinary income.

You should complete this form if you make a personal super contribution using the capital proceeds of the sale of certain small business assets and you elect to exclude. Maximum tax rate on long term gains. For example the total capital gains realized in 1986 climbed by over 7 of us gross domestic product up from 39 the prior year.

3 the increase in total capital gains realized in 2012 was not as drastic but noticeable nonetheless. Form t664 was a tax form used to make an election to report a capital gain on property owned at the end of february 22 1994. Hold an investment for longer than a year though and the.

To use up your remaining capital gains exemption you will need to file revenue canadas form t664 election to report a capital gain on capital property owned at the end of february 22 1994 with your 1994 return by may 1 1995. 11 to make the election for 1995 kenyon would enter all or part of the amount of the next gain on line 4c form 4952 which would treat that amount must also be entered on line 3 of the capital gain tax worksheet in the form 1040 instructions removing it from the amount eligible for the maximum tax rate of 28. You will find two copies of this form in the middle of this package.

If you remember back 15 years that was the year that revenue canada cra eliminated the general capital gains exemption on most types of assets. Total capital gains realized vs. You elect by filing form t664 election to report a capital gain on property owned at the end of february 22 1994.

Currently taxes on capital gains depend primarily on how long you own your stock or other investment.

More From Election Commission Of India Card Check

- Primary Election 2020 Map Results

- Presidential Election Quiz Questions

- Usaha Rumahan Makanan Ringan

- Election Commission India Jobs

- Election Card Form 8 In Gujarati

Incoming Search Terms:

- 2017 Schedule C Form 1040 Beautiful Irs Gov Capital Gains Worksheet New 2011 Child Tax Worksheet New 16 Models Form Ideas Election Card Form 8 In Gujarati,

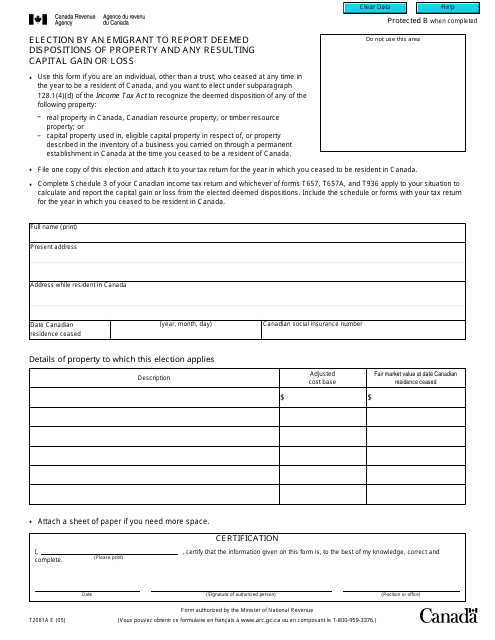

- Form T2061a Download Fillable Pdf Or Fill Online Election By An Emigrant To Report Deemed Dispositions Of Taxable Canadian Property And Capital Gains And Or Losses Thereon Canada Templateroller Election Card Form 8 In Gujarati,

- Hp 1065 Partnership Return Election Card Form 8 In Gujarati,

- Treaty Based Synthetic Basis Step Up Election For Australian Nationals Election Card Form 8 In Gujarati,

- Tax Information Election Card Form 8 In Gujarati,

- Https Mafiadoc Com Download 2013 Instructions For Schedule D Form 1065 59bd2c5e1723ddf1eba12cd9 Html Election Card Form 8 In Gujarati,